It has now been more than six years since a research paper released under the pseudonym of Satoshi Nakamoto marked the beginning of a transformation of the mechanisms that we currently use for the transfer and safe-keeping of information at an international scale. But his paper, where Bitcoin was first introduced, was only meant to shed light on a technology that had an even greater disruption potential: blockchain.

Some months ago, the team at the SCET created the first version of a study that explained the basics of blockchain and the advancements that at the time deemed it one of the most promising technologies to benefit a myriad of industries.

In this second version we revisit and evaluate the developments that blockchain technology has seen in the past year, paying close attention to both the most obvious routes that it has taken for its rapid adoption such as the incursion into international payment and settlement systems, to some of the most controversial applications that scholars have suggested for its implementation such as conceiving a blockchain-based decentralized government.

The Fed Enters the Picture

It is no mystery that, as with any other technology, blockchain credibility will very well depend on how much current influential players in the industry pay attention to it. This is why it is key to recognize that the Federal Reserve finally decided to talk about blockchain last December. The institution decided to go well beyond a simple acknowledgment in a press conference, and decided to release a much-awaited research paper titled “Distributed Ledger Technology in Payments, Clearing and Settlement” in which it explored the possibilities of the integration of a distributed ledger in the financial industry, as well as surveyed the legal and governance challenges facing the development of any of the technology’s future proofs-of-concept.

During the event where the research paper was released, the Chairman of the Fed, Janet Yellen, emphasized that blockchain technology “could have very significant implications for the payments system.” Interestingly enough, later that same week, the Federal Reserve’s Board issued a clarifying statement explaining that the research paper released was only a “very general introduction to the structure of the payment systems and the potential uses of distributed ledgers” and that the publication “barely mentions any role for the Federal Reserve, other than the need to consider whether new regulations will be required to fit the potential uses of the technology.” However, even after this clarifying note, the fact is that moving forward the players in the industry will have to take into account the implications of having the Fed as a new player in the field which is taking its first steps to making sure it doesn’t get left behind.

Organizing Disruption

Most supporters of blockchain technology have come to agree that the only way of accelerating the adoption of distributed ledger technologies is for industry leaders to come together and consolidate common strategies that would enable the technology to grow.

This argument makes sense: there is a need to achieve a critical mass of enterprises implementing the technology not only to establish it as a serious operational strategy, but also to significantly decrease the risk of adoption for other smaller players in the industry.

This type of consortia was on every advocate’s wish list until a couple months ago. Now, it’s become a reality with the Muskoka Group. Muskoka is a group of several cryptocurrency industry leaders that has recently issued a Call to Action, in which the participants all agreed to cooperate in order to make blockchain technology as pervasive and easily adoptable in their systems and organizations as possible. The Group will be involved in everything from creating communication programs to help explain the way Blockchain works and clarify misconceptions around the usage of the technology, all the way to developing a roadmap for government leaders at all levels to facilitate the much-needed regulatory reforms that would enable blockchain infrastructure truly scalable.

Redefining International Capital Markets

According to the World Economic Forum’s Future of Financial Infrastructure Report , as of August of 2016, there were more than twenty-four countries investing in Distributed Ledger Technologies (or blockchains), more than 80% of banks predicted to initiate DLT projects by the end of 2017, and more than $1.4 billion dollars in investments poured into this technology.

Most of these investments have been channeled into initiatives that intend to disrupt the way in which the international financial structure operates on a daily basis. McKinsey’ report on blockchain’s application to capital markets rightly confirms that blockchain has the potential to dramatically reshape the capital markets industry, having a significant impact on business models, reductions in risk and savings of cost of capital.

One of the clearest examples is the operation of all trading transactions. At the moment, a transaction of securities requires a settlement process in which both parties verify that they possess the actual securities and the liquidity to pay for such exchange. With blockchain, since the information of the available resources of each party would already be available to both agents as part of the distributed ledger, there wouldn’t be a need to check for the existence of these. According to McKinsey, the elimination of the period of settlement between the transaction of the securities would eliminate credit and liquidity risk by requiring pre-funding prior to trading, at the same time that it would free up the capital that previously needed to be locked up by firms for periods of even five days in order to settle some transactions.

However, the consulting firm also stresses that financial firms and banks will inevitably be facing challenges while aiming to implement blockchain technology into their operations. For example, blockchain transactions cannot be amended after the act. This lack of recourse, which is in fact an important part of the technology’s proposition, actually represents a problem for capital market participants who will need to agree on recourse mechanisms that can be pre-programmed. Having said this, it is easy to see how application of the technology doesn’t stop with settlement of securities on a trading floor. Blockchain, by freeing up capital and providing information about available resources to the agents involved in any type of arrangement, has the potential to redefine the the financing and operation of international trade.

From the perspective of the private sector, there have also been interesting developments in the past year. For example, despite slow adoption by some of the bigger players, some of the most influential financial institutions have started to invest more of their time and resources to both understand and come up with strategies to implement the technology into their operative infrastructure. The clearest example of this type of initiative comes from Santander, which just last year piloted a blockchain-based payment mobile application. With this initiative, the bank became the first institution in the United Kingdom’s finance industry to make a large-scale deployment of this technology from a consumer-facing standpoint.

In this specific case, the application of blockchain technology will revolve around providing customers with next-day money transfers and ensure that customers’ funds arrive in full. With this application, customers can now send anything between 10 to 10,000 sterling pounds or American dollars across the bank’s branches in twenty-one countries. This is a clear example of how the bank intends to make operational improvements on two important fronts: time of settlement and delivery of payments between its customers, and a reduction in the amount of capital that would otherwise would to go other financial intermediaries in the form of fees.

Other businesses have proven to be even more creative. For example, IBM just announced a couple of days ago its launch of IBM Blockchain, a “blockchain as a service” for enterprises, which is aimed at providing bigger market players with the ability to build their own scalable and secure blockchain networks in order to significantly increase efficiency in their own processes.

The service is backed by the Linux Foundation (which has been, not surprisingly, one of the biggest supporters of the Muskoka Group). During the launch of IBM Blockchain the company made sure to point out that “blockchain networks are only as safe as the infrastructures on which they reside” which, besides being true, provides the organization with an interesting way of positioning itself in today’s market. Now, IBM’s clients will be expected to host their networks in IBM Cloud after consolidating them through IBM Blockchain, effectively securing another steady (and rapidly increasing) stream of revenue for the organization. At current capacity, IBM Blockchain can sustain as many as 1,000 transactions per second.

No more than a couple of months ago, a privately-held company documented its issuance of shares to investors significantly reducing settlement time and eliminating the need for paper stock certificates. Nasdaq already announced that it will be further exploring the application of blockchain technology to create a proxy voting system for the election in Estonia, tapping into another field in which the technology could have significant influence: democracy, political systems and nation-wide governance.

Can blockchain change the face of democracy?

According to the World Economic Forum, distributed ledger technology will significantly increase transparency between involved participants. In the private sector, blockchain has the potential of putting an end to market fragmentation, in which some agents have been able to profit from having access to information that some others hadn’t and through which they might have gained unfair competitive advantage, such as insider trading. What if we could apply the same principles and the same power of DTL into public sector’s operation and its multi-layered governmental system?

The technology clearly has the potential to become disruptive in processes such as the restructuring of voting during election periods, or the monitoring by the average citizen of how the public budget is being spent. In the public sector, blockchain has the power of becoming a true enabler of accountability and if fully implemented, the technology could be especially interesting for not only for the governments in developed countries, but also in emerging markets, where corruption and lack of transparency have been two key obstacles to improving public services and increasing society’s living standards.

There are some blockchain advocates, however, that have decided to take it to the next level and pose a question regarding the consequences of blockchain technology and a distributed ledger replacing the government itself. In a recent analysis made by Ariel Deschapell from Ubitquity, the author explains that the strategy of having a human being as a decision-maker is overrated, given that a person’s knowledge is limited and humans are always prone to making mistakes which can “often ruin both companies and nations”. With a distributed ledger, all information would be available to everyone. Getting ahead of his critics, Deschapell writes the following controversial lines:

“The absence of a central authority figure is also not synonymous with a lack of leadership. To the contrary, it means anyone and everyone is able to lead. The difference is that without compulsion, different ideas and solutions must openly compete against each other. No one can be forced to accept any service or use any software. The resulting competition means that multiple solutions to different problems can be market tested and users will ultimately vote with their feet.”

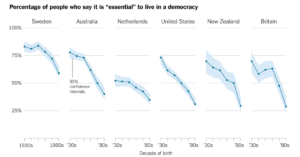

It might seem difficult for blockchain to disrupt governance systems that have been in place for decades, or sometimes even centuries. Nevertheless, according to a study carried out by the New York Times (below), it might just be the right time to start thinking of reinventing ourselves.

Society is changing, and its members think the concept of democracy might need some fine-tuning.