The SCET has previously covered news of how banks had shown increased collaboration with fin-tech startups in 2015 and 2016; the underlying psychology there was that it is easier for large banks to acquire startups that are successfully able to create innovative financial technology, rather than invest time, money and effort in R&D themselves. This very philosophy may now have reversed on banks, as fin-tech companies have become an increasingly larger threat and have driven away revenue from such banks. Nowhere else is this more apparent than in news this past week of Goldman Sachs – its revenue drop of 40% and income drop of 60% highlights Wall Street’s pain: banks just aren’t making enough money anymore.

After five of the six biggest U.S. banks posted shrinking revenue in the quarter from a year earlier, analysts are starting to raise tough questions about the future ability of big investment banks to generate the same revenue they used to. Goldman’s revenue fall of 40% was the sharpest among the banks. Morgan Stanley on Monday posted a revenue drop of 21%, following declines of 3% to 11% at bigger, more diversified banks that also have large consumer-lending businesses. Investments in financial technology have growth exponentially in the past decade — rising from $1.8 billion in 2010 to $19 billion in 2015 — with over 70% of this investment focusing on the “last mile” of user experience in the consumer space.

Citi Bank sums up its own fate perfectly: “Although FinTech companies have the advantage of new innovation, incumbent financial institutions still have the upper hand in terms of scale and we have not yet reached the tipping point of digital disruption in either the US or Europe. Given the growth in FinTech investment, this isn’t likely to continue for long.” In a report highlighting how disruption by Fin-tech companies is pushing banks ‘to their tipping point.’ Even JP Morgan’s dynamic CEO, Jamie Dimon has warned his employees, “Silicon Valley is coming. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking… there is much for us to learn in terms of real-time systems, better encryption techniques, and reduction of costs and pain points for customers.”

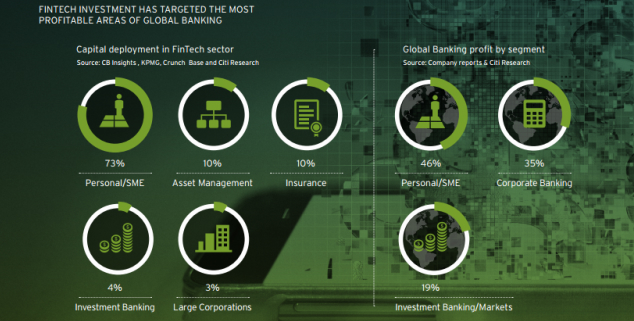

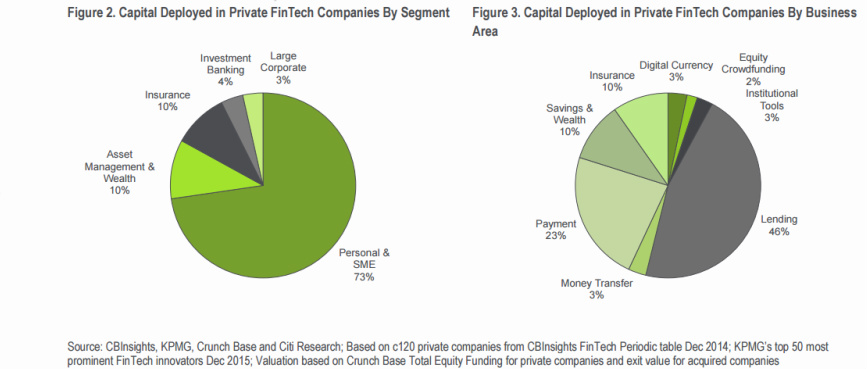

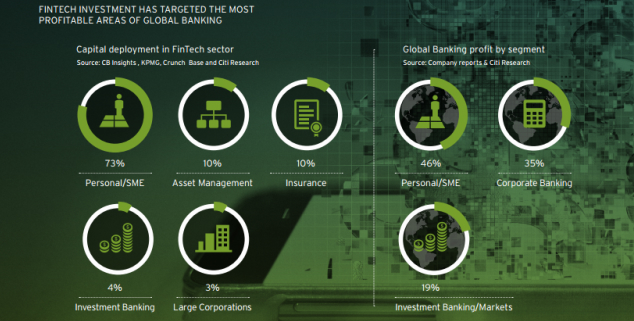

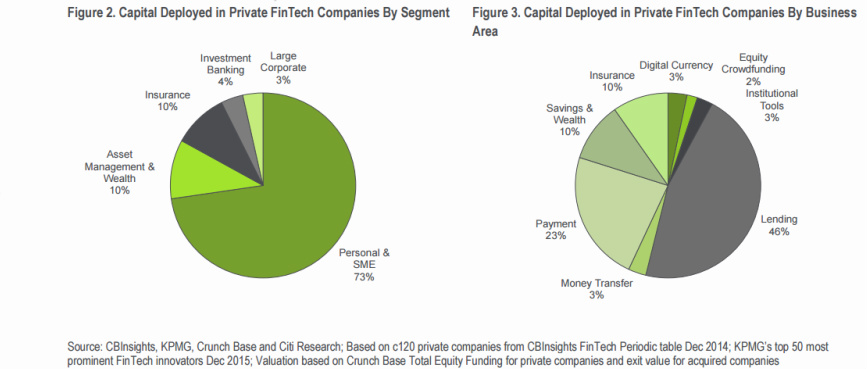

FinTech investments have grown exponentially in recent years: $19 billion of investment in 2015 was up two-thirds from $12 billion in 2014 and from low single-digit billions of dollars per year earlier in the decade. New entrants are targeting Personal and SME banking which account for about half of banking industry’s profit pool.

China is already past the ‘tipping point’. Top Chinese FinTech companies, such as Alipay or Tencent, already have as many, if not more clients as the major banks around the world. Emerging Markets are going through a financial inclusion revolution. Emerging markets are ripe for FinTech disruptions due to “a high percentage of unbanked population, relatively weak consumer banks, and a high penetration of mobile phones.”

“The death of banks has been much foretold in recent decades,” most notably by Bill Gates in a 1994 article where he argued “that the world needed banking services but not necessarily banks…” Since then, “we have seen digital disruption fundamentally erode value across many industries including: music sales, video rentals, travel booking, and newspapers. In each of these cases, incumbents either transformed or became marginalized.” 2016 is a crucial year in terms of what lies ahead for both traditional banks and the FinTech startup world – but there is little doubt over the fact that the competition in the industry is and will become even more intense.

The SCET has previously covered news of how banks had shown increased collaboration with fin-tech startups in 2015 and 2016; the underlying psychology there was that it is easier for large banks to acquire startups that are successfully able to create innovative financial technology, rather than invest time, money and effort in R&D themselves. This very philosophy may now have reversed on banks, as fin-tech companies have become an increasingly larger threat and have driven away revenue from such banks. Nowhere else is this more apparent than in news this past week of Goldman Sachs – its revenue drop of 40% and income drop of 60% highlights Wall Street’s pain: banks just aren’t making enough money anymore.

After five of the six biggest U.S. banks posted shrinking revenue in the quarter from a year earlier, analysts are starting to raise tough questions about the future ability of big investment banks to generate the same revenue they used to. Goldman’s revenue fall of 40% was the sharpest among the banks. Morgan Stanley on Monday posted a revenue drop of 21%, following declines of 3% to 11% at bigger, more diversified banks that also have large consumer-lending businesses. Investments in financial technology have growth exponentially in the past decade — rising from $1.8 billion in 2010 to $19 billion in 2015 — with over 70% of this investment focusing on the “last mile” of user experience in the consumer space.

Citi Bank sums up its own fate perfectly: “Although FinTech companies have the advantage of new innovation, incumbent financial institutions still have the upper hand in terms of scale and we have not yet reached the tipping point of digital disruption in either the US or Europe. Given the growth in FinTech investment, this isn’t likely to continue for long.” In a report highlighting how disruption by Fin-tech companies is pushing banks ‘to their tipping point.’ Even JP Morgan’s dynamic CEO, Jamie Dimon has warned his employees, “Silicon Valley is coming. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking… there is much for us to learn in terms of real-time systems, better encryption techniques, and reduction of costs and pain points for customers.”

FinTech investments have grown exponentially in recent years: $19 billion of investment in 2015 was up two-thirds from $12 billion in 2014 and from low single-digit billions of dollars per year earlier in the decade. New entrants are targeting Personal and SME banking which account for about half of banking industry’s profit pool.

China is already past the ‘tipping point’. Top Chinese FinTech companies, such as Alipay or Tencent, already have as many, if not more clients as the major banks around the world. Emerging Markets are going through a financial inclusion revolution. Emerging markets are ripe for FinTech disruptions due to “a high percentage of unbanked population, relatively weak consumer banks, and a high penetration of mobile phones.”

“The death of banks has been much foretold in recent decades,” most notably by Bill Gates in a 1994 article where he argued “that the world needed banking services but not necessarily banks…” Since then, “we have seen digital disruption fundamentally erode value across many industries including: music sales, video rentals, travel booking, and newspapers. In each of these cases, incumbents either transformed or became marginalized.” 2016 is a crucial year in terms of what lies ahead for both traditional banks and the FinTech startup world – but there is little doubt over the fact that the competition in the industry is and will become even more intense.