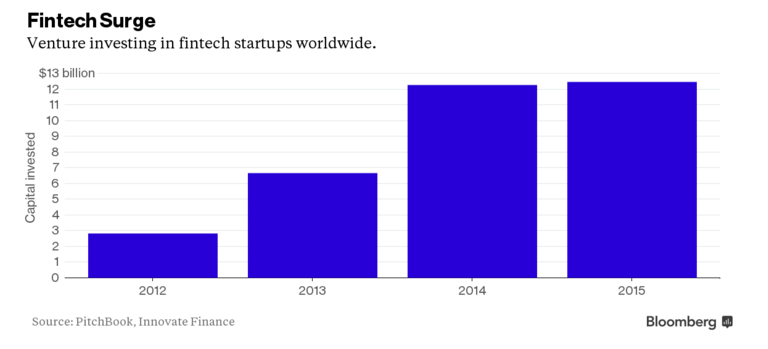

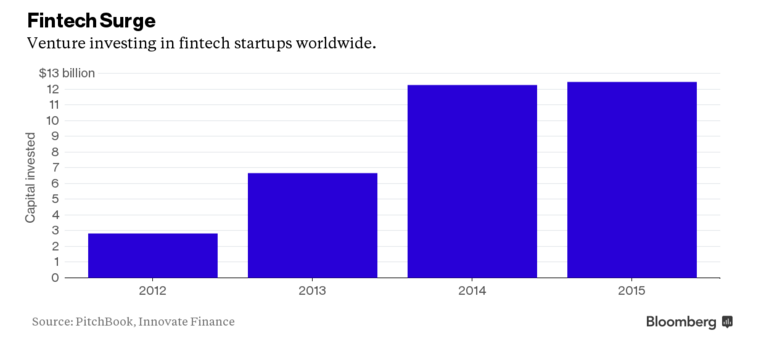

In a constantly changing world where innovation has been dominated by payment, insurance, investment management, and market provision related financial technology, the world’s largest banks are beginning to show signs of fear at conceding to the startup world. Existing difficulties around low interest rates, lack of confidence in governments and increased assurance from private corporations are driving fin-tech away from research departments at bulge bracket banks and towards startups worldwide. Israel, London, and specially the Silicon Valley have all shown a significant increase in revenues by startups, and Oliver Wyman estimates that within the next ten years, startups can compete to grab about $150bn in revenue from sectors the bulge bracket banks are relying on.

However, as usual, bulge brackets seem to have a clever idea to maintain power. As an MD at Accenture in London described, ‘The story has gone from one of competition to one of collaboration.’ Banks such as Barclays, UBS and Citigroup are increasingly encouraging co-creation, inspiring entrepreneurs at sponsored boot-camps to think of potential unicorn ventures and do the work banks usually would spend time and money on. The model, one where startups often pay to use resources of the bank, saves banks both time and money, and allows them to develop a positive PR with startups they may later end up absorbing or acquiring.

The stakes at risk are big. Online lending is growing 151% annually. Investing has almost completely moved away from brokerages to personalized apps, block-chain technology is finally expanding; the financial sectors entire infrastructure is transforming – and about two dozen banks are hosting incubators, accelerators, hackathons and competitions to invite innovative minds to do their thinking for them.

The idea behind such movements is that even if the research done within closed doors at banks comes up with something innovative, implementing and experimenting is a timely and costly process that in an environment of thin margins, the likes of UBS and Wells Fargo do not wish to deal with.

It’s still early days to reach a conclusion on the true angle banks are pursuing with such ventures – it may simply be a PR campaign being replicated due to a herd effect by banks. But the increasingly clear message is that such programs now represent the best way for banks to now conduct important cutting-edge research in the fin-tech industry. It remains to be seen in the near future whether the entire movement is a PR campaign to show ‘they’re doing something’ or if banks are truly ready to rewire their infrastructure.

In a constantly changing world where innovation has been dominated by payment, insurance, investment management, and market provision related financial technology, the world’s largest banks are beginning to show signs of fear at conceding to the startup world. Existing difficulties around low interest rates, lack of confidence in governments and increased assurance from private corporations are driving fin-tech away from research departments at bulge bracket banks and towards startups worldwide. Israel, London, and specially the Silicon Valley have all shown a significant increase in revenues by startups, and Oliver Wyman estimates that within the next ten years, startups can compete to grab about $150bn in revenue from sectors the bulge bracket banks are relying on.

However, as usual, bulge brackets seem to have a clever idea to maintain power. As an MD at Accenture in London described, ‘The story has gone from one of competition to one of collaboration.’ Banks such as Barclays, UBS and Citigroup are increasingly encouraging co-creation, inspiring entrepreneurs at sponsored boot-camps to think of potential unicorn ventures and do the work banks usually would spend time and money on. The model, one where startups often pay to use resources of the bank, saves banks both time and money, and allows them to develop a positive PR with startups they may later end up absorbing or acquiring.

The stakes at risk are big. Online lending is growing 151% annually. Investing has almost completely moved away from brokerages to personalized apps, block-chain technology is finally expanding; the financial sectors entire infrastructure is transforming – and about two dozen banks are hosting incubators, accelerators, hackathons and competitions to invite innovative minds to do their thinking for them.

The idea behind such movements is that even if the research done within closed doors at banks comes up with something innovative, implementing and experimenting is a timely and costly process that in an environment of thin margins, the likes of UBS and Wells Fargo do not wish to deal with.

It’s still early days to reach a conclusion on the true angle banks are pursuing with such ventures – it may simply be a PR campaign being replicated due to a herd effect by banks. But the increasingly clear message is that such programs now represent the best way for banks to now conduct important cutting-edge research in the fin-tech industry. It remains to be seen in the near future whether the entire movement is a PR campaign to show ‘they’re doing something’ or if banks are truly ready to rewire their infrastructure.