With the largest population in the world along with a vast implementation of data and internet connectivity, China’s retail sector has seen exponential growth over the past decade, making it one of the most innovative in the world. Many China-born retail technologies and business models, from social e-commerce to new retail to online-offline integration, have been a favorite amongst investors. With the rapid increase of retail technologies, industrial innovation, and data usage, unicorns have appeared frequently and are shaping the new retail industry. So how can China continue supporting its growing technology-first retail ecosystem? How has the role of social media impacted retail globally, and how can China leverage its influence to funnel further growth?

On March 18, 2021, the Sutardja Center for Entrepreneurship & Technology organized a roundtable discussion on ‘The Chinese Retail Ecosystem and the Influence of Social Media,’ co-hosted by Cheung Kong Graduate School of Business (CKGSB), one of China’s leading business schools. The conversation was moderated by Rui Ma, founder and host of Tech Buzz China, and a UC Berkeley alum. Alongside Rui Ma, several distinguished panelists – Michael Chen Wang (Founder of Cider, a global fast-fashion brand with a 100% online presence), Dr. Paul Yan (Vice President of JD Group, a Fortune Global 500 retail company), Baohong Sun (Professor of Marketing at CKGSB), and Joy Tang (CEO of Markable AI, known as Mai, a Series-A startup working on artificial intelligence for e-commerce and advertising) – engaged in discussions surrounding how China has entered a whole new data-and-technology-driven retail ecosystem with the growing impact of social media.

The Overall Retail Industry

The conversation began with a lengthy discussion on the overall retail sector and how the COVID-19 pandemic disrupted the industry. The main takeaway was that the retail sector has experienced both challenges and opportunities this past year – from the disruption of conventional business models to the deployment of social media and online channels to meet rapidly evolving customer demands (given the lengthy shelter-in-place regulations and remote work conditions).

As a result, the overall retail industry is undergoing a global revolution. Retailers now face two significant challenges: the change in consumer structure due to shifting behavior along with the emergence of innovative business models and opportunities given by digital brand transformation. Now more than ever, retailers have to reposition and embrace innovative technologies to open the data barrier between each selling channel, to avoid possible customer loss, customer transfer risk, and product management issues. These critical problem areas have all been adequately addressed by the implementation of technology in most areas of retail, from freight transportation and supply-chain logistics to end-user distribution channels, leading to specific companies and regions adapting to these changes more rapidly and effectively than others. One such region happens to be China, where technology and disruption have always been welcome, especially amongst the emerging data-driven retail companies in the region.

Chinese E-Commerce Retail

Rui Ma kicked off the discussion of the Chinese e-commerce retail ecosystem, giving some background about the size of the industry:

- Most studies place Chinese e-commerce at ~35% of retail.

- McKinsey values Chinese e-commerce at more than $1 trillion, which is greater than the value of the next 9 markets combined.

These statistics demonstrate how large and advanced the Chinese e-commerce market is, despite the acceleration in e-commerce observed across the rest of the world due to the pandemic. Rui Ma went on to mention that there are “lots of factors that contribute to why China has such advanced e-commerce”, highlighting the high density in urban areas, tremendous investments in logistic chains, and a complete supply chain, not to mention everyone has a digital payment option on their mobile phones which makes transactions much, much cheaper than in the United States. Advancements in Chinese retail have become an industry benchmark across the globe, placing China at the forefront of retail, and specifically e-commerce, innovation.

E-commerce innovations in China can be divided into three main types:

- Innovation at the platform level, such as at Amazon or JD.com:

- Dr. Yan’s background working at the JD Group helped him provide various examples of how platform-level innovation has taken place at JD.

- He mentioned that last year, JD.com earned $115 billion in revenue, making it the biggest retail in China by far.

- In the last 12 months, JD added 110 million active buyers to take their total active buyers to 471 million. The importance of metrics and data at Chinese companies was becoming apparent to the roundtable audience of the roundtable, as Dr. Yan gave several examples of how the JD Group’s success can be quantitatively measured and tracked.

- The focus on data and data-driven decision-making can be attributed to being the most influential innovation at the platform level for retail companies.

- Another example of platform-level innovation is the technical integration of offline-and-online e-commerce, which allows consumers to order online and pick up their order offline. Not only does this improve the buying experience for users but it also speeds up the delivery time, guaranteeing delivery in less than 24-hours across China.

- Innovation at the channel level, such as at a store that sells multiple brands like Sephora or a singular brand like Cider or Warby Paker:

- Professor Sun states the focus on making the customer decision journey frictionless has led to tremendous innovation at the channel level for e-commerce in China. The focus on removing friction from the customers’ decision-making process led Chinese retailers to place greater importance on audio-visual mediums to help with persuading consumers. Given that social media was the best at handling multi-media content, Chinese retailers pushed to integrate e-commerce into Chinese social media platforms such as TikTok and Bilibili, which was tremendously successful.

- Innovation at the brand level, as specifically seen over social media brand profiles:

- Joy Tang speaks of another type of innovation at the brand level where retailers and brands are now focusing on performance advertising on e-commerce marketplaces. Performance advertising, which runs on artificial intelligence to the audience’s perception of content, thus allows for organic growth of the brand, thereby making not only the consumer journey frictionless but also the brand’s journey as frictionless as possible.

Chinese E-Commerce and Social Media

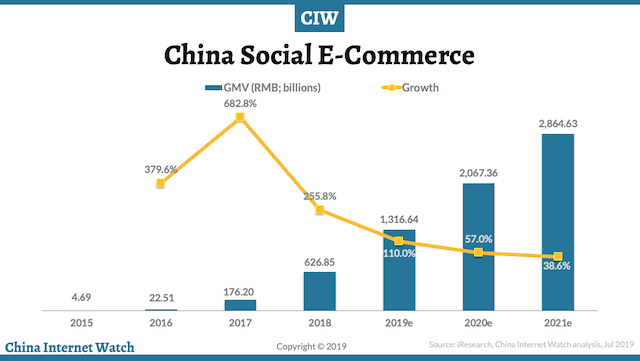

One of the key aspects of the successful Chinese e-commerce story has been the utilization of social media to push retail towards consumers. The panelists mentioned WeChat, China’s most popular social commerce platform which now boasts more than one billion users, as an example of China’s triumph in bringing the commerce experience to people’s phones in a social setting. The term coined to explain e-commerce via social media platforms is ‘social e-commerce’, a channel that Chinese retailers perfected over the last five years. The Innovation-X Roundtable panelists pointed to the phenomenal growth observed by the Chinese social e-commerce market, slated to increase from ¥4.69 billion in 2015 to a projected ¥2.865 trillion by 2021, as illustrated by the graph below.

While the growth rate of social e-commerce has been slowing, the instrumental increase in the overall Gross Merchandise Value (GMV) of Chinese social e-commerce has defined a new channel of retail by itself. The panelists discussed what this means for China in the global setting, coming to the conclusion that apps like TikTok will make way for easier worldwide access to Chinese e-commerce along with a growing international demand for Chinese brands.

The roundtable conversation then proceeded towards looking at what the future holds for the Chinese retail ecosystem and how social e-commerce will evolve post the pandemic. To hear more about Chinese retail and the utilization of social media, do check out the event recording and hear from our esteemed panelists below!