Economics’ Not-So-Hidden Hand

Behavioral economics has been much in the public eye this century, whether it was Daniel Kahneman’s 2002 Nobel Prize in economics, Robert Shiller’s in 2013, Richard Thaler’s in 2017, or Dan Ariely’s excellent 2008 New York Times best-seller, Predictably Irrational. These works have highlighted that human decision making isn’t informed solely by the cold calculus of rational economics, but equally by the emotions that govern so much of our behavior.

Behavioral economics richly embroiders our offline lives, best illustrated by the enviable success of the Trader Joe’s grocery chain. The company regularly tops the dunnhumby retailer performance index, while delivering per square foot revenue numbers that exceed the industry average by at least a factor of two. The secret to Trader Joe’s success? It’s “a real-life case study of behavioral economics at work,” leading the Freakonomics podcast to posit “should Trader Joe’s be running America?” A companion question for all innovative companies might now be, “should Trader Joe’s — actually, behavioral economics — be driving your technology strategy?”

Starbucks Coffee… and the Goal-Gradient Hypothesis?

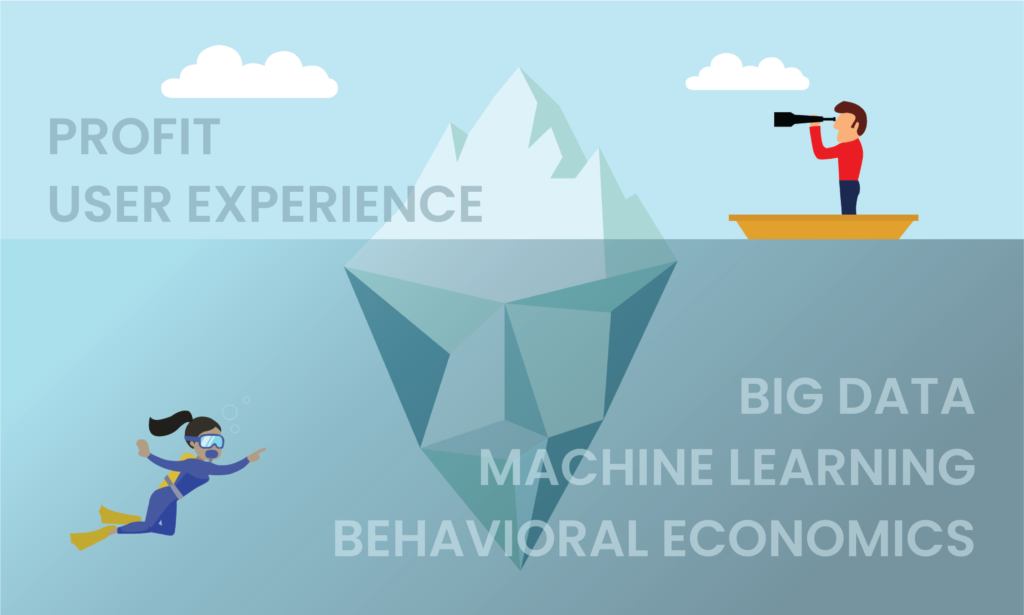

The secret history of Big Tech is steeped in the practice of behavioral economics. After all, what’s an even bigger business advantage than using machine learning and Big Data to predict what’s going to happen? Why, it’s using behavioral economics, machine learning and Big Data, in a real-time, never-ending cybernetic loop, to actually drive what’s going to happen.

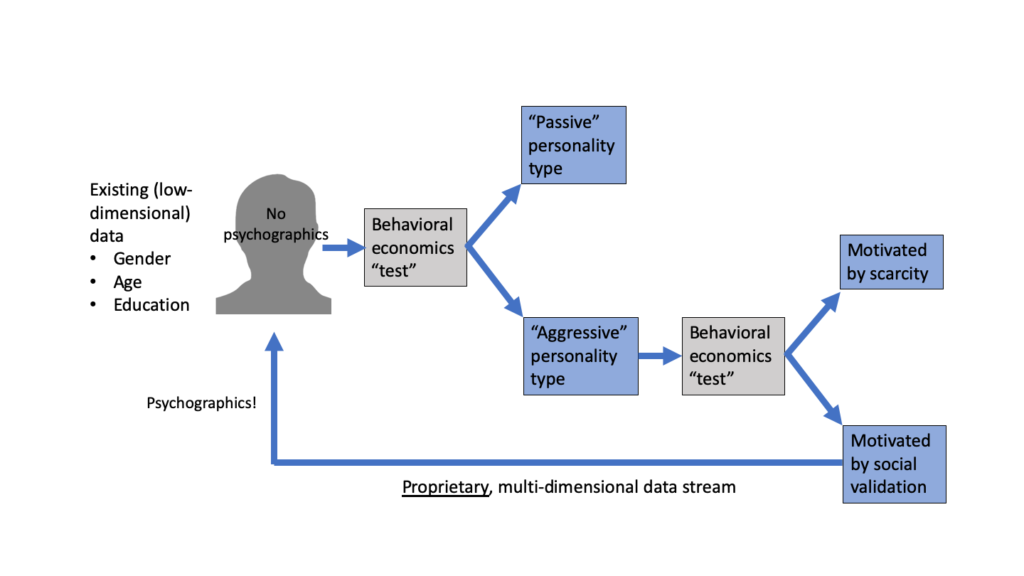

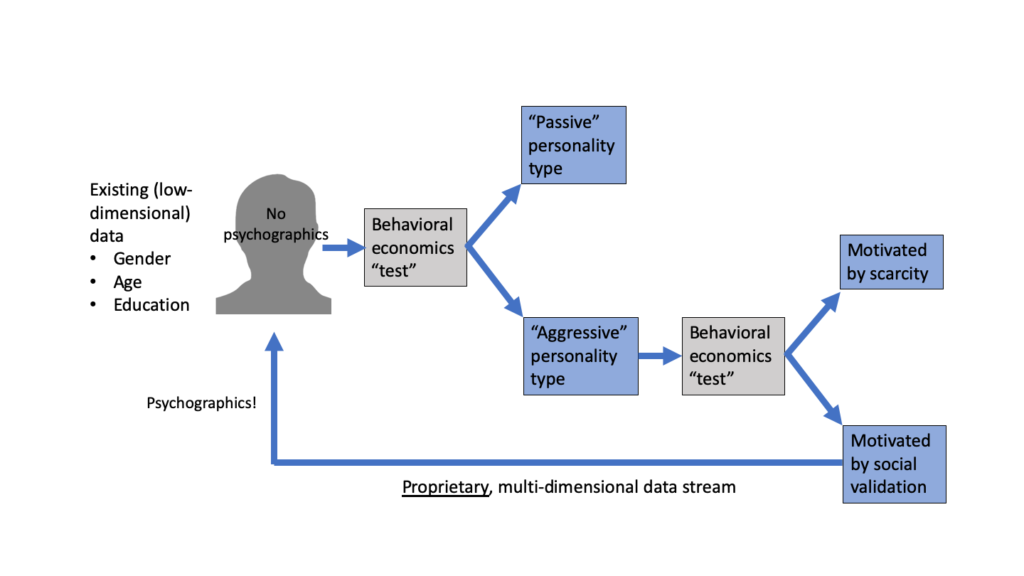

Whether it’s Amazon (Congiu, Moscati 2018), Uber, Facebook (Kramer, Guillory, Hancock 2014) or Netflix (Castro et al. 2019), the adepts of Big Tech have a well-documented understanding and appreciation of the application of behavioral economics to drive behavior that’s advantageous to their business models. Indeed, in the data-centric landscape which is the basis of our AI Century, behavioral economics can provide a crucial and potent data stream — specifically, psychographics down to the individual level — which is proprietary and yields unique insight.

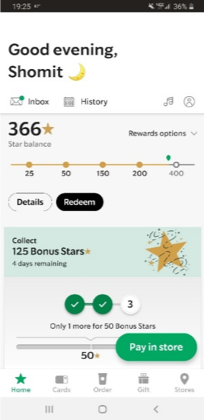

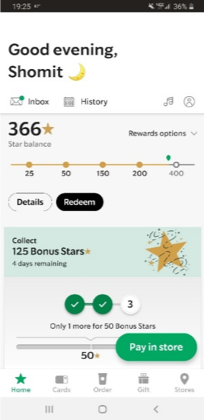

We may know the international chain, Starbucks, as the purveyor of our favorite coffee drinks, not as a practitioner of data-driven behavioral economics. But Starbucks’ mobile phone app is the acme of behavioral economics through software, actively driving repeat custom through: regular (very!) nudges; gamification (bonus star rewards, culminating in Gold Star status); urgency (“4 days remaining”); the goal-gradient (Kivetz, Urminsky Zheng 2006) of the progress bar (“Only 1 more for 50 Bonus Stars”); and misdirection (note that the spacing between 25 and 50 stars is the same as between 200 and 400 stars).

It should be no surprise that through its loyalty program and mobile app, Starbucks has amassed cash deposits (interest-free!) that exceed the assets of many banks. The coffee company’s mastery of behavioral economics brings new meaning to the term “bean counters.” It would clearly be insufficient to compete with Starbucks merely on the battlefield of price of coffee drinks.

These Aren’t the Droids We’re Looking For…

As with all human inventions, behavioral economics has a broad spectrum of application. Equally can it be used to improve the profitability of the diamond retailing business (Wu, Cosguner 2018) and also to change candidate preferences in hiring contexts (Chang, Cikara 2018). But the use of subtle behavioral techniques to influence our right to make free choices can be a danger. Online trading firm Robinhood has been the subject of much recent scrutiny due to the effects of its behavioral economics practices on its customers.

Behavioral economics’ “dark pattern” (Mathur et al. 2019) techniques have been widely used by companies online, and widely censured by consumer protection organizations around the world. In September 2020, the US Federal Trade Commission levied a $10 million fine against children’s online education company Age of Learning, while Amazon’s dark patterns have been cited by both the Norwegian Consumer Council and the UK’s Advertising Standards Authority.

The Device-Formerly-Known-as-Your-Cell-Phone

Behavioral economics is a particularly powerful force because we humans seem to be naturally susceptible to its effects (Liao, Zhang, Li, Li, Zilioli, Wu 2018, Mao, Oppewal 2012). What’s more, with some 3.8 billion smart phones at humanity’s disposal in 2021, the two-way flow of data these devices enable now provides a perfect platform for the deployment of real-time behavioral economics.

Heretofore, the application of behavioral economics online has been restricted mostly to the realm of getting subjects to click the “Buy” button. This has been both a source of Big Tech’s success and also the etiology of its dysfunction. Now, in addition to deploying behavioral economics in business as Starbucks and the major players in Big Tech have done, can we also employ it for the nobler goal of bettering life?

Behavioral economics in support of social good may seem paternalistic. However, in their seminal article “Libertarian Paternalism” (The American Economic Review 2003), Richard Thaler and Cass Sunstein have pointed out that beneficial behavioral economics can address problems via “an approach that preserves freedom of choice but that authorizes both private and public institutions to steer people in directions that will promote their welfare” (“suitably defined”). In short, the world is faced with many problems. Does the ubiquity of real-time, two-way data streams coupled with the “zero cost” attached to behavioral economics yield a means of achieving individual and societal good that is scalable across the human population?

Welfare “Suitably Defined”

Behavioral economics applied for good has been demonstrated in a range of fields, with everything from helping people increase their savings (Thaler, Benartzi 2004) to managing household energy use (Frederiks, Stenner, Hobman 2015). The greatest impact of the libertarian paternalism of behavioral economics may, however, be in the field of healthcare. Nowhere in the world does humanity find itself sufficiently resourced in the basic need of healthcare. In the era of Big Data and smartphones, the amalgamation with behavioral economics can provide a cost-effective mechanism to help us achieve healthy lives.

For example, cardiovascular diseases (CVD) have now become the leading cause of mortality in India (Prabhakaran, Jeemon, Roy 2016), and also affect nearly half of American adults; CVDs have impact in all regions of the world, across all income strata. Behavioral economics has shown potential to provide a scalable, non-clinical (“non-contact”) means of achieving powerful impacts in heart health (Chang et al. 2017) measured in reduced incidence, increased quality-adjusted life years, and reduced systemic costs (Mozaffarian et al. 2018).

Similar promise for behavioral economics in healthcare has been shown in everything from colorectal cancer screening (Stoffel, Yang, Vlaev, von Wagner 2019), to nutrition (Ammerman, Hartman, DeMarco 2016), clinical trial enrollment (VanEpps, Volpp, Halpern 2016), clinical decision support systems (Cho, Bates 2018), and the UK government’s response to the coronavirus pandemic. The scope of “suitably defined” beneficial applications of behavioral economics in healthcare is broad and has just begun to be tapped.

Ethics: Mr. Weasley’s Rule

“Never trust anything that can think for itself if you can’t see where it keeps its brain.”

J.K. Rowling, Harry Potter and the Chamber of Secrets

Libertarian paternalism notwithstanding, none of the positive impacts above is achievable without ethics as a necessary substrate to behavioral economics. If our technology solutions are unethical, or even arouse the mere suspicion of unethical behavior, then they will rightly go unused. At all times our solutions must strive to deliver ethics through transparency: disclosing what data is being collected, by whom, how it is being leveraged through behavioral economics, what outcomes are being driven, and always on an opt-in basis. Ethics demands transparency, and transparency demands ethics.

Ich Bin Ein Behavioral Economist

Actually, by education and profession I’m a computer scientist. But fully tapping the positive potentials of today’s software technologies — Big Data, machine learning, AI — requires a keen appreciation of the power of behavioral economics. We must burn our incense at the altar of Kahneman as well as that of Knuth.

The pragmatist’s confession is that life is a zero-sum game: every dollar spent here is a dollar that cannot be spent there. Framed by this reality, behavioral economics affords us the opportunity to achieve a certain set of positive impacts (e.g., keeping us healthy) with minimal expense, thereby enabling us to steward our limited resources to be better spent where they’re truly needed (e.g., on interventions when we’re sick).

Like Starbucks and the familiar names of Big Tech, today’s technology’s winners are those who realize, and internalize, that there’s a continuity, not a chasm, between standard economics and behavioral economics. To compete against this cadre of companies, mere Big Data, machine learning and standard economics are not enough. Deploying ethical behavioral economics, in concert with the data-driven technologies, is the imperative. Let’s all become adepts of behavioral economics.

I promise that I have been inspired to write this article through my own volition, and have been under no external behavioral economics influence in its writing. To the best of my knowledge.

Economics’ Not-So-Hidden Hand

Behavioral economics has been much in the public eye this century, whether it was Daniel Kahneman’s 2002 Nobel Prize in economics, Robert Shiller’s in 2013, Richard Thaler’s in 2017, or Dan Ariely’s excellent 2008 New York Times best-seller, Predictably Irrational. These works have highlighted that human decision making isn’t informed solely by the cold calculus of rational economics, but equally by the emotions that govern so much of our behavior.

Behavioral economics richly embroiders our offline lives, best illustrated by the enviable success of the Trader Joe’s grocery chain. The company regularly tops the dunnhumby retailer performance index, while delivering per square foot revenue numbers that exceed the industry average by at least a factor of two. The secret to Trader Joe’s success? It’s “a real-life case study of behavioral economics at work,” leading the Freakonomics podcast to posit “should Trader Joe’s be running America?” A companion question for all innovative companies might now be, “should Trader Joe’s — actually, behavioral economics — be driving your technology strategy?”

Starbucks Coffee… and the Goal-Gradient Hypothesis?

The secret history of Big Tech is steeped in the practice of behavioral economics. After all, what’s an even bigger business advantage than using machine learning and Big Data to predict what’s going to happen? Why, it’s using behavioral economics, machine learning and Big Data, in a real-time, never-ending cybernetic loop, to actually drive what’s going to happen.

Whether it’s Amazon (Congiu, Moscati 2018), Uber, Facebook (Kramer, Guillory, Hancock 2014) or Netflix (Castro et al. 2019), the adepts of Big Tech have a well-documented understanding and appreciation of the application of behavioral economics to drive behavior that’s advantageous to their business models. Indeed, in the data-centric landscape which is the basis of our AI Century, behavioral economics can provide a crucial and potent data stream — specifically, psychographics down to the individual level — which is proprietary and yields unique insight.

We may know the international chain, Starbucks, as the purveyor of our favorite coffee drinks, not as a practitioner of data-driven behavioral economics. But Starbucks’ mobile phone app is the acme of behavioral economics through software, actively driving repeat custom through: regular (very!) nudges; gamification (bonus star rewards, culminating in Gold Star status); urgency (“4 days remaining”); the goal-gradient (Kivetz, Urminsky Zheng 2006) of the progress bar (“Only 1 more for 50 Bonus Stars”); and misdirection (note that the spacing between 25 and 50 stars is the same as between 200 and 400 stars).

It should be no surprise that through its loyalty program and mobile app, Starbucks has amassed cash deposits (interest-free!) that exceed the assets of many banks. The coffee company’s mastery of behavioral economics brings new meaning to the term “bean counters.” It would clearly be insufficient to compete with Starbucks merely on the battlefield of price of coffee drinks.

These Aren’t the Droids We’re Looking For…

As with all human inventions, behavioral economics has a broad spectrum of application. Equally can it be used to improve the profitability of the diamond retailing business (Wu, Cosguner 2018) and also to change candidate preferences in hiring contexts (Chang, Cikara 2018). But the use of subtle behavioral techniques to influence our right to make free choices can be a danger. Online trading firm Robinhood has been the subject of much recent scrutiny due to the effects of its behavioral economics practices on its customers.

Behavioral economics’ “dark pattern” (Mathur et al. 2019) techniques have been widely used by companies online, and widely censured by consumer protection organizations around the world. In September 2020, the US Federal Trade Commission levied a $10 million fine against children’s online education company Age of Learning, while Amazon’s dark patterns have been cited by both the Norwegian Consumer Council and the UK’s Advertising Standards Authority.

The Device-Formerly-Known-as-Your-Cell-Phone

Behavioral economics is a particularly powerful force because we humans seem to be naturally susceptible to its effects (Liao, Zhang, Li, Li, Zilioli, Wu 2018, Mao, Oppewal 2012). What’s more, with some 3.8 billion smart phones at humanity’s disposal in 2021, the two-way flow of data these devices enable now provides a perfect platform for the deployment of real-time behavioral economics.

Heretofore, the application of behavioral economics online has been restricted mostly to the realm of getting subjects to click the “Buy” button. This has been both a source of Big Tech’s success and also the etiology of its dysfunction. Now, in addition to deploying behavioral economics in business as Starbucks and the major players in Big Tech have done, can we also employ it for the nobler goal of bettering life?

Behavioral economics in support of social good may seem paternalistic. However, in their seminal article “Libertarian Paternalism” (The American Economic Review 2003), Richard Thaler and Cass Sunstein have pointed out that beneficial behavioral economics can address problems via “an approach that preserves freedom of choice but that authorizes both private and public institutions to steer people in directions that will promote their welfare” (“suitably defined”). In short, the world is faced with many problems. Does the ubiquity of real-time, two-way data streams coupled with the “zero cost” attached to behavioral economics yield a means of achieving individual and societal good that is scalable across the human population?

Welfare “Suitably Defined”

Behavioral economics applied for good has been demonstrated in a range of fields, with everything from helping people increase their savings (Thaler, Benartzi 2004) to managing household energy use (Frederiks, Stenner, Hobman 2015). The greatest impact of the libertarian paternalism of behavioral economics may, however, be in the field of healthcare. Nowhere in the world does humanity find itself sufficiently resourced in the basic need of healthcare. In the era of Big Data and smartphones, the amalgamation with behavioral economics can provide a cost-effective mechanism to help us achieve healthy lives.

For example, cardiovascular diseases (CVD) have now become the leading cause of mortality in India (Prabhakaran, Jeemon, Roy 2016), and also affect nearly half of American adults; CVDs have impact in all regions of the world, across all income strata. Behavioral economics has shown potential to provide a scalable, non-clinical (“non-contact”) means of achieving powerful impacts in heart health (Chang et al. 2017) measured in reduced incidence, increased quality-adjusted life years, and reduced systemic costs (Mozaffarian et al. 2018).

Similar promise for behavioral economics in healthcare has been shown in everything from colorectal cancer screening (Stoffel, Yang, Vlaev, von Wagner 2019), to nutrition (Ammerman, Hartman, DeMarco 2016), clinical trial enrollment (VanEpps, Volpp, Halpern 2016), clinical decision support systems (Cho, Bates 2018), and the UK government’s response to the coronavirus pandemic. The scope of “suitably defined” beneficial applications of behavioral economics in healthcare is broad and has just begun to be tapped.

Ethics: Mr. Weasley’s Rule

“Never trust anything that can think for itself if you can’t see where it keeps its brain.”

J.K. Rowling, Harry Potter and the Chamber of Secrets

Libertarian paternalism notwithstanding, none of the positive impacts above is achievable without ethics as a necessary substrate to behavioral economics. If our technology solutions are unethical, or even arouse the mere suspicion of unethical behavior, then they will rightly go unused. At all times our solutions must strive to deliver ethics through transparency: disclosing what data is being collected, by whom, how it is being leveraged through behavioral economics, what outcomes are being driven, and always on an opt-in basis. Ethics demands transparency, and transparency demands ethics.

Ich Bin Ein Behavioral Economist

Actually, by education and profession I’m a computer scientist. But fully tapping the positive potentials of today’s software technologies — Big Data, machine learning, AI — requires a keen appreciation of the power of behavioral economics. We must burn our incense at the altar of Kahneman as well as that of Knuth.

The pragmatist’s confession is that life is a zero-sum game: every dollar spent here is a dollar that cannot be spent there. Framed by this reality, behavioral economics affords us the opportunity to achieve a certain set of positive impacts (e.g., keeping us healthy) with minimal expense, thereby enabling us to steward our limited resources to be better spent where they’re truly needed (e.g., on interventions when we’re sick).

Like Starbucks and the familiar names of Big Tech, today’s technology’s winners are those who realize, and internalize, that there’s a continuity, not a chasm, between standard economics and behavioral economics. To compete against this cadre of companies, mere Big Data, machine learning and standard economics are not enough. Deploying ethical behavioral economics, in concert with the data-driven technologies, is the imperative. Let’s all become adepts of behavioral economics.

I promise that I have been inspired to write this article through my own volition, and have been under no external behavioral economics influence in its writing. To the best of my knowledge.