Located in the heart of Silicon Valley, the University of California Berkeley, is known for its extremely rigorous courses that encourage students to reach their full potential. This, along with a vast entrepreneurship network, is why UC Berkeley has topped PitchBook’s ranking list for entrepreneur count for three years in a row. PitchBook’s Annual Top 50 Universities Report provides an extensive overlook of the venture capital industry within the scope of universities’ programs. The recently released 2017-2018 edition includes data on the “Top Universities for VC-backed Entrepreneurs”, “Top Companies by Capital Raised”, and much more. Overall, UC Berkeley is notably the top public university on the list of undergraduate programs, coming in a close second to Stanford, with an entrepreneur count of 1089, company count of 961, and capital raised at $17,050 million.

Cal also came in second for the “Capital Raised” category. The top five companies that raised the most capital include: Cloudera, Zynga, Auris Surgical Robotics, Machine Zone, and Sapphire Energy. It is Auris Surgical Robotics’ first year on the list. The other four companies made it to the top of the last year’s list in the 2016 PitchBook report.

In the section for Female Founders, while UC Berkeley fell from second to third place from last year, the amount of capital raised by these women-founded companies is almost equivalent to that of Stanford, which is in first place. Last year, female-led companies of UC Berkeley alumni raised around $1,479 M, whereas this year they raised $1,678 M. This section features five top female-led Berkeley-associated companies: Sapphire Energy, One Kings Lane, Quantenna Communications, Terra Bella, and Millendo Therapeutics.

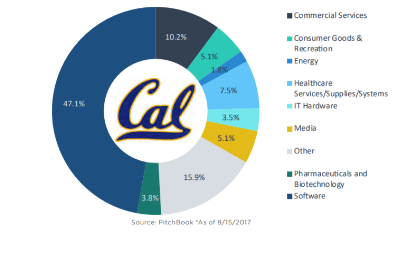

Within the Sector Breakdown category, UC Berkeley is ranked #1 with a total of 960 companies. The largest sector at 47.1% represents the fact that a majority of UC Berkeley’s companies have to do with software. Other highly ranked universities’ companies are mainly in the software industry as well.

Overall, PitchBook emphasizes the impactful nature of investment funds and affiliations with VCs in surrounding areas “on the number of students that pursue their ambitions to start a company of their own.” The network effect is prevalent in the venture capital industry, and the report aims to display the quantitative evidence behind the positive influence of entrepreneurial networks. Here at Berkeley, where a high emphasis is placed on the maintaining its robust entrepreneurial networks, The Berkeley Gateway to Innovation (BEGIN) initiative has curated a website for the entrepreneurship community on campus with lists of resources available at Berkeley to educate entrepreneurs, commercialize research, and advance startups.