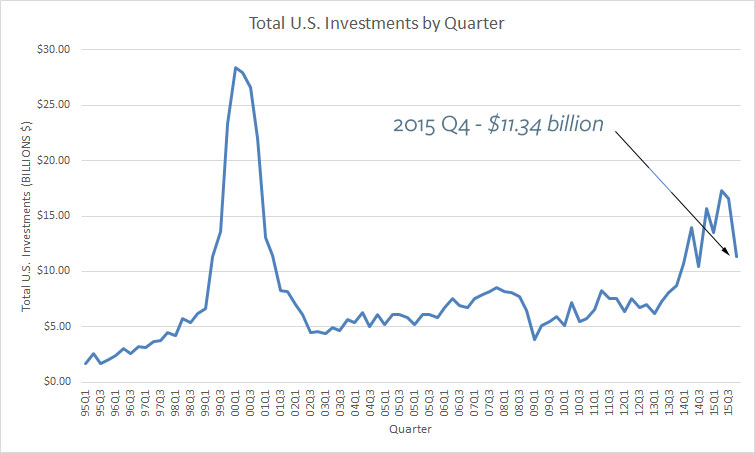

2015 Exceptional Year for VC Investment Despite 4th Quarter Drop

According to a recent report by PricewaterhouseCoopers and National Venture Capital Association, approximately $58 billion was invested in 2015. This highest total in fifteen years is a positive indicator for startups and entrepreneurs looking for capital to launch the their next big idea.

Total U.S. Investments by Year

Source: PricewaterhouseCoopers/National Venture Capital Association MoneyTree™ Report, Data: Thomson Reuters

While this is certainly good news, the fourth quarter total of $11.34 billion represents a significant drop from the previous quarter (with a total of $16.61 billion invested). This has many wondering if this is the beginning of the next bust cycle. The only year to beat 2015 in terms of total investments was the year 2000 when a staggering $104 billion was invested. The year 2000 holds special significance — especially for those in the tech world — as it marked the beginning of the dotcom crash that ended in 2002 when only $22 billion was invested (which started a trend of relatively low annual investment totals until very recently).

It is easy to see the parallel between today and 2000, but some argue that the environment today is different. In 2000, when the internet was younger and more chaotic, investors jumped at anything that looked like it could be the next big thing. Today, investors are more cautious. They are still looking for big ideas — but are also interested in how the company will make money. In 2000, it was more unclear how online companies could profit, but today there are many standardized business models that companies can build into their plan. And in the overall scheme of things, the fourth quarter of 2015 was actually very good ranking in the top 15% of all quarters since 1995.

Others argue that what goes up, must come down. While investors and tech companies have seemingly worked out some of the instability associated with ventures during the dotcom bubble, it is not inconceivable that we are currently in a smaller one that could burst in 2016.