The Sutardja Center is hosting a Blockchain Technology Collider which will focus on emerging applications of blockchain technology beyond the commonly known “bitcoin” use case. Launch date is March 2nd at 5pm, please RSVP at http://blockchaincollider.eventbrite.com. Contact David Law at dlaw@berkeley.edu with questions. Click here for more information.

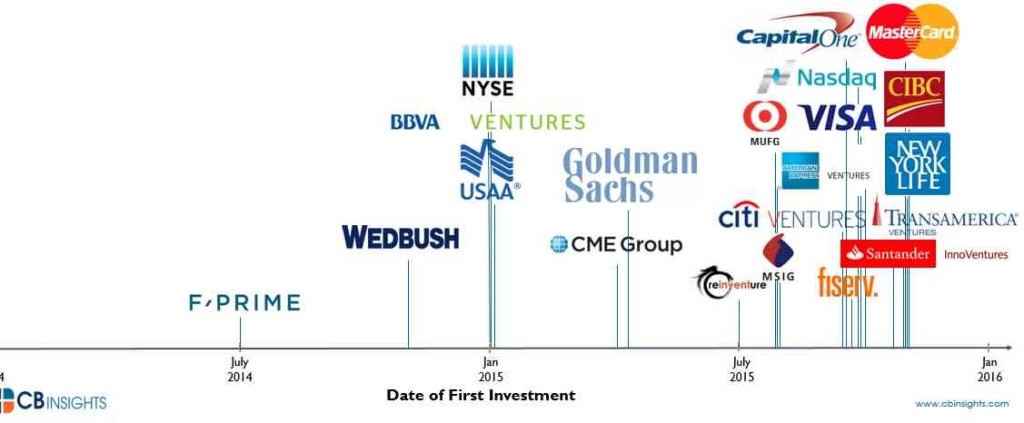

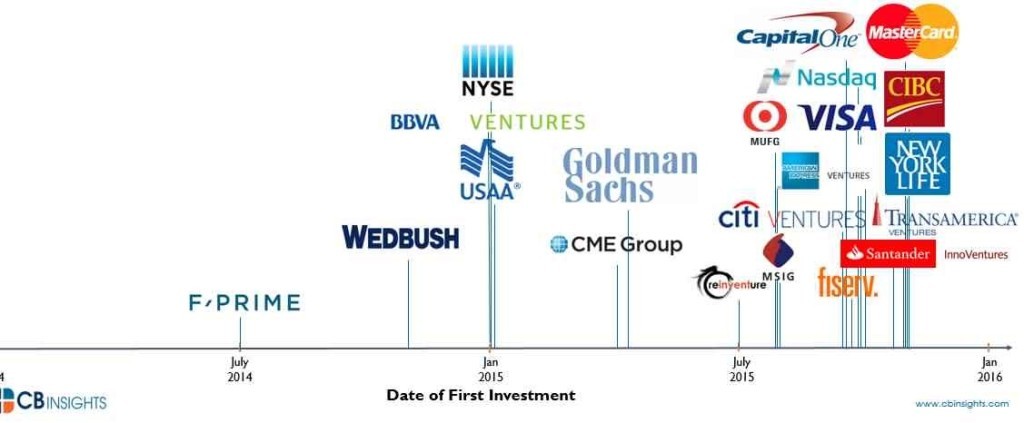

Blockchain, the decentralized ledger system used to record transactions for the digital bitcoin currency has recently stirred up attention from renowned investors; it now has the backing of major banks as well as large corporations around the USA.

By the beginning of July 2015, more than $800m had already been invested in blockchain related technology and startups – the likes of IDG Capital, Khosla Ventures, Boost VC, Union Square Ventures and many others have shown strong intent to back the bitcoin currency.

Nine of the largest banks on Wall Street, including JP Morgan & Citi in January funded Digital Asset Holdings, a startup run by Blythe Masters, an ex-JPM whiz, for $50m in its efforts to find applications of Blockchain and bitcoin on Wall Street. “There has been a great deal of discussion about the potential benefits of utilizing distributed ledger technology, but less in the way of real-world deployment,” Ms. Masters said in an interview.

Though Blockchain-based platforms are still in their infancy, banks think there is potential for big cost savings over current mechanisms, with some estimating that within the next five years, the Blockchain system could shave over $16bn out of the $54bn spent in costs on global clearing.

This past week, IBM joined the listed of banks promoting the growth of the hyper-ledger, by becoming the single largest backer of the digital currency platform. In the coming year, IBM itself will begin experimenting with variations of the Blockchain in an attempt to simplify processes and increase transparency for customers who lease IBM’s computer hardware. “I think the number of places that a distributed ledger can be used could become almost limitless,” said Arvind Krishna, a senior vice president of IBM. IBM intends for Hyperledger to make blockchain faster, more scalable and easier to use, Mr. Krishna said. It also expects the software to provide advantages for owners of IBM hardware.

It can clearly be seen that investment and trust in the bitcoin currency and the blockchain hyperledger system have significantly increased; IBM’s recent backing of the platform provides yet another reassuring signal for investors and entrepreneurs in the fin-tech space who are trying to use blockchain and bitcoin to challenge the integrity and usefulness of traditional currency and accounting.