Few are more qualified to gauge the growth of Fintech, or know more about the global financial industry than Anju Patwardhan. A globally recognized thought leader for banking and technology, an influencer and speaker at institutions like the UN and World Bank, and Chief Innovation Officer at Standard Chartered, Anju has dedicated her 17 years in the industry to disruptions in the realm of finance. With a resume longer than most monthly bank statements, Anju boasts diverse experiences ranging from academic institutions (UC Berkeley, Stanford, MIT, NUS & Singapore Management University), banks (Citigroup, Standard Chartered), political institutions (World Economic Forum, consulting for governments), as well as companies such as CreditEase, where she holds active leadership roles.

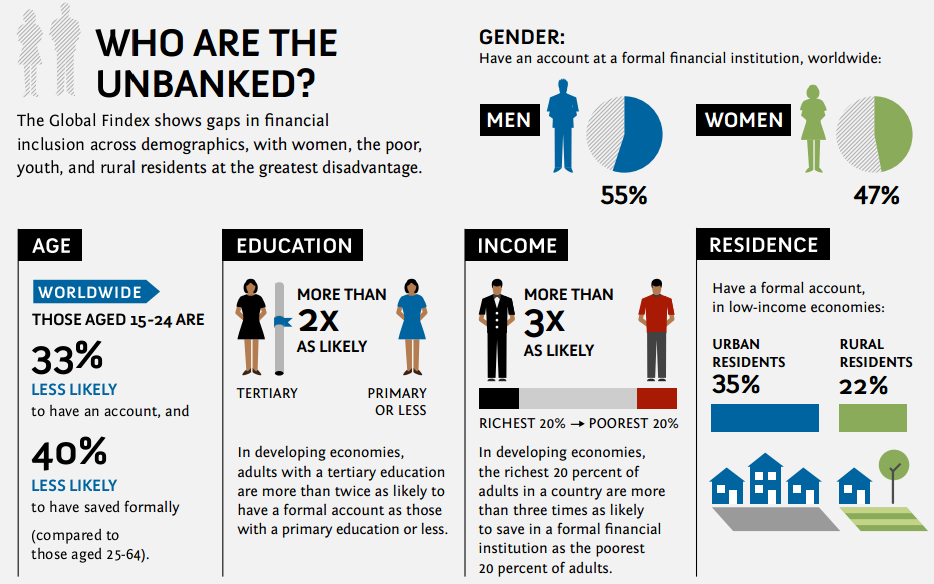

A specific topic that’s dominated fintech is addressing the developing world, enabling low income workers, and finding success at where large banks and institutions have failed over the years. The lack of finance has prevented over 200m small and medium enterprises from growing; an increasing number of businesses with immense potential end up bankrupted due their inability to finance simple working capital needs. The lack of credit is not just something that effects businesses, but families at an individual level – in South Asia in particular among other developing nations, the availability of credit is the difference between sacrificing one’s children’s educations for a low income job; it is the difference between a bad personal loan that may end up leading to generations of bonded labor, or between increasing or decreasing crime rates – and while some may argue that these are social vices, it is trivial to see they would be nonexistent and are caused by a fundamental lack of credit that enables development. Four main problems – the lack of infrastructure (resulting in a large proportion of the global population not having access to internet), the inability to afford cell phones, or access to the internet, a lack of awareness and education (a strong need for basic financial literacy exists), and lack of content (most of the internet’s data is in 12 languages, and there is a strong understanding gap), are holding back credit accessibility and business growth. Hence, financial inclusion is becoming an increasing focus – with a large total addressable market & a strong need for financial services, it offers the strongest growth opportunities to startups.

Anju’s recognition of the importance of financial inclusion stems all the way back to when she worked in risk management in Citi Asia. Having met a number of small businesses, she realized that commercial banking faced a huge gap – there was no way to identify creditworthiness or assign a score to businesses. ‘One of the largest problems I faced was the question, how do you make lending to such small businesses commercially viable?’ she said. Trying to lend to segments that didn’t have data sources, or where underwriting was manual, is a problem that still exists in a number of developing countries in Asia.

Today, largely due to the growth of the mobile wallet, and increased smartphone penetration in developing countries, alternate data points that help evaluate financial credibility exist – capitalizing on these data points, and interpreting them in ways that can help SMEs secure loans, is the key to allowing and increasing number of people credit facilities. The problem for banks however, is that the credit requirements of such firms are high in complexity, low in scale; the opportunity cost of spending time and infrastructure evaluating such loans and taking on the risk for a small reward is high. For a lot of developing countries, primary requirements, such as identity (1.7b people in the world do not have a legal identity) can be a huge problem.

Here’s where Fintech presents the opportunity to be a game changer, according to Anju. The ability of fintech startups to help collect a ‘digital mobile footprint’ is enabling advanced analytics and new business models that can be used to gauge credibility for loans. Unconventional data points and machine learning processes are being used to assess credit risks associated with SMEs. As Anju states in a recent interview with SMU, “It is possible to reduce the cost of underwriting, and therefore it is possible for big banks to now do this in a commercially viable manner. That’s an area that is done very well by a lot of fintech companies but not so well yet by the banks, but hopefully there will be progress in the future.”

SCET’s Financial Inclusion Collider aims to work on similar fintech solutions that may act as game-changers, proposing customized, effective & profitable solutions for credit that would increase global credit and financial access.

Anju Patwardhan is a Fulbright Fellow at Stanford University and was Standard Chartered’s global Chief Innovation Officer until July 2016. She is also an Innovation Fellow at National University of Singapore’s NUS Enterprise and serves on various World Economic Forum steering committees. She currently serves as an Industry Fellow and Fintech Collider Advisor at the Sutardja Center for Entrepreneurship and Technology – to learn more about the UC Berkeley Collider System and Anju Patwardhan, click here. To view financial inclusion and its role in financial stability from a more academic perspective, click here.